Since the "Made in China 2025" was put forward, the robot market has been in a "crazy" state. Local governments have built a large number of robotic industrial parks by adding codes to robotic projects. Under the "high subsidies" and "price war", robotic enterprises have sprung up like mushrooms, and even real estate and Internet enterprises have "crossed" to share a cup. Looking back at the robotics industry, from the merger boom in 2016 to the investment boom in 2017, and then to the waste heat of investment in 2018, the financing scale has increased nearly 30 times. The influx of capital brings spring breeze to the industry and also subverts the ecological system of the industry. At the same time, China's robotics industry has appeared the trend of "low-end high-end industry", and there are worries of overinvestment. The problem of blind expansion and low-level repeated construction of robotics enterprises is obvious.

Current Situation of Domestic Robot Industry with Capital Aid

Capital is a double-edged sword. It not only promotes the rapid expansion of the robotics industry, but also brings chicken feathers. Investors are looking for policy subsidies and capital dividends, pursuing "fast-in and fast-out" capital returns, the best target of investment can be listed for three years; contrary to this, industrial robots belong to low-key traditional manufacturing industry, the company grows slowly and needs long-term accumulation of technology. Before capital entry, the robot industry grows in exploration, through orderly competition in the market. Enterprises with real technology and strength can grow and develop.

The unrealistic high expectation and high valuation of the powerful robotic enterprises due to their ignorance of the industry is also a kind of pressure. When they find that the growth of the company is not as expected, they can not carry out their own strategies and tactics well, which results in the lack of hematopoietic capacity of the company. They can only relieve themselves by acquiring higher valuation of the financing rounds after rounds. There has been tremendous pressure on investors since the previous round.

The collapse of Tangbao Robot in 2018 and the collapse of Rethink Robotics, the ancestor of cooperative robots, were both affected by capital. The former was the first robot product in China to be certified as "China Robot". Last year, Tangbao Robot Company was deeply involved in the collapse because of the breakdown of its capital chain. Wang Minggao, the founder of the company, has now left the United States. The latter has more than 150 million rounds of financing, but the sales volume is low, which can not meet the expected growth. Eventually, because of the problems in the capital chain, it withdraws from the historical stage.

Is the low-cost strategy of robots feasible?

Last year, the price war of robotic enterprises led to a sharp reduction in profits of domestic enterprises, which further led to the reduction of R&D investment. The reduction of R&D investment will in turn affect the performance and sales of products. This cycle is also the difficulty for many domestic enterprises to survive.

Early on, relying on this tragic low-price strategy is obviously not conducive to the development of the industry. Companies that implement this low-price and high-volume strategy can not meet the earnings requirements of investors. They just shout for loss and profit. With the "calm" of capital, they will inevitably face a severe test.

Influenced by the "low-price strategy" of the domestic industrial robot market, the trend of "quantity reduction and price slippage" of imported robots may continue. Increasingly tilting their focus to the Chinese market, international giants have begun or begun to prepare for price reduction, especially in Kawasaki, where only such enterprises have the capital to fight price war and seize the Chinese market through a large number of shipments.

Overdemand in Industrial Robot Industry

In fact, we can see from a series of data that although the market demand for robotic automation is still rising, there is a clear trend of overcapacity in China's robotic market. According to the data of the National Bureau of Statistics, the output of industrial robots declined by 3.3% in October 2018 from a year earlier, and has been declining for five consecutive months since June 2018.

How Domestic Robot Enterprises Break Out

At present, foreign giants have reached a mature stage. Each giant grasps the vast majority of the market and technology, with low risk but high returns. And the domestic robot manufacturers are still in the process of growing from the initial stage of high-risk and low-profit to the stage of high-risk and high-profit. In the case of excess domestic capacity, stagnant market and positive impact from major foreign brands, how to break through the siege of domestic industrial robots enterprises is a question we should consider.

Although the financing proportion of the whole industry declined by nearly 50% in 2018, the amount of financing is the sum of 2016 and 2017, and more and more financing is concentrated in some advantageous enterprises. The financing scale of individual enterprises is increasing, mainly in machine vision, cooperative robots, AGV enterprises and other emerging sub-areas.

Industrial robotics industry has been a capital-intensive industry, and there is a huge demand for capital. In such an industry context, excellent companies in the industry must actively learn capital-related knowledge, access to capital, understand capital, and be good at utilizing capital.

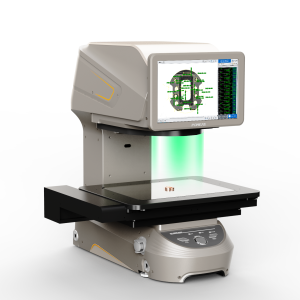

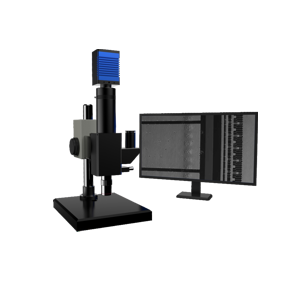

Product recommendation

TECHNICAL SOLUTION

MORE+You may also be interested in the following information

FREE CONSULTING SERVICE

Let’s help you to find the right solution for your project!

ASK POMEAS

ASK POMEAS  PRICE INQUIRY

PRICE INQUIRY  REQUEST DEMO/TEST

REQUEST DEMO/TEST  FREE TRIAL UNIT

FREE TRIAL UNIT  ACCURATE SELECTION

ACCURATE SELECTION  ADDRESS

ADDRESS Tel:+ 86-0769-2266 0867

Tel:+ 86-0769-2266 0867 Fax:+ 86-0769-2266 0867

Fax:+ 86-0769-2266 0867 E-mail:marketing@pomeas.com

E-mail:marketing@pomeas.com